FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Descrição

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

:max_bytes(150000):strip_icc()/W-2-6a38541136824d2481dfde8e6146cf44.jpeg)

Form W-2 Wage and Tax Statement: What It Is and How to Read It

FICA Tax: Rates, How It Works in 2023-2024 - NerdWallet

What is FICA Tax? - The TurboTax Blog

The Complete Guide to Independent Contractor Taxes - NerdWallet

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

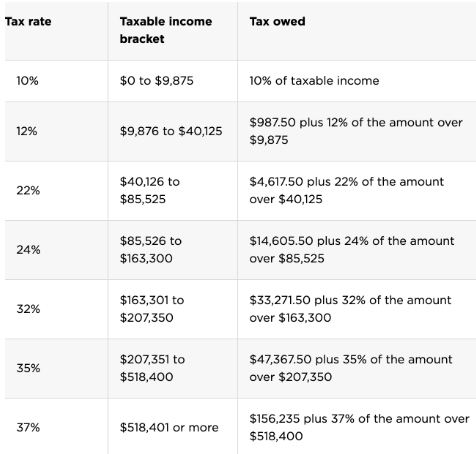

The Difference Between Marginal Tax Rates and Effective Tax Rates — and When to Use Them. - Thompson Wealth Management

Qualified Business Income Deduction (QBI): What It Is - NerdWallet

NerdWallet 2023 Tax Report - NerdWallet

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Self-Employed Health Insurance Deductions

Restricted Stock Units: What You Need to Know About RSUs - NerdWallet

Learn About FICA Tax and How To Calculate It

Solved An employee earned $50,000 during the year. FICA tax

de

por adulto (o preço varia de acordo com o tamanho do grupo)